The story so far:

In April 2017, reforms were rolled out to the public sector to tackle non-compliance. These reforms led to the public authority making the determination on whether the worker was caught by the IR35 rules. If the off-payroll rules applied then the public authority or fee payer (i.e. agency) that paid the PSC became responsible for deducting and paying the PAYE/NI across to HMRC. Before these reforms, the decision on whether the IR35 legislation applied to each individual contract was made by the worker. You can recap the previous changes here.

HMRC estimate that the cost of non-compliance in the private sector is growing to £1.3bn a year by 2023/24. With PAYE receipts increasing and independent research commissioned by HMRC suggesting that the reforms have been successful in increasing compliance in the public sector, they've decided to roll out these changes to the private sector with some proposed tweaks.

The second stage consultation – proposed changes

After the previous consultation published in May 2018, HMRC recognise that there are lessons to be learnt from the public sector roll out and aim to use the public sector reforms as a starting point in the private sector reforms. This consultation aims to seek advice on the ways to address several concerns raised by stakeholders on the public sector reforms including: communication of determinations, blanket determinations, appeals processes & support given to organisations ahead of changes. HMRC have proposed some changes to meet these concerns:

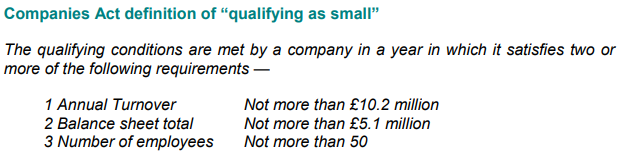

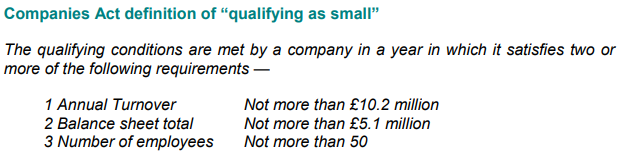

Small Business Exemption

In response to concerns raised about the capacity of particularly smaller organisations to cope with these reforms, HMRC has decided that small businesses who fit the Companies Act 2006 definition will not be affected by the reforms – and therefore not need to determine the status of any off -payroll workers they engage.

Instead, the current rules will stand, where the workers themselves are responsible for determining their own status. This shouldn’t create any additional admin for the worker as compliant PSCs should be doing this currently.

Information Flow

The communication and reasons behind the determination of IR35 status for the worker was highlighted as a concern through the previous consultation. To help ensure all parties need to have sufficient information to allow them to comply with their obligations and responsibilities, HMRC propose that the client will be required to provide the determination & reasons directly to the worker as well as the party they contract with. Each party will then pass the determination/reasons to the next party in the chain.

Non-Compliance

To make sure all parties comply with their responsibilities where HMRC do not receive the PAYE/NI, the liability will rest with the party who has failed to fulfil their obligations – and this will revert back up to the first party/agency in the chain.

Reasonable care

Concerns were raised around the lack of a process to challenge the determination. One suggestion to combat this was the information flow processed mentioned earlier.

A client led disagreement process should be created to help workers challenge the determination if they disagree, meaning fewer people should need to use the current year end process – on which there isn’t too much information. Medium/large organisations are likely to have HR functions in place to help manage workplace disputes which can help develop the challenge process for this.

Education & Support

HMRC created a Check Employment Status for Tax (CEST) service to help people decide the status of workers and whether the off-payroll rules apply. There has been much controversy around the tool with arguments that existing case law isn’t taken into account and whether the tool itself can handle the complex and diverse nature of the private sector. HMRC are currently working with stakeholders to address these concerns.

HMRC will produce an education and support package to help towards preparation and implementing the changes. This will aim to help all those affected end clients, fee payers & workers. The support infrastructure is one of the reasons the rules are coming into play from April 2020, as opposed to 2019.

A few other changes to be aware of

Student loan – this wouldn't be in consideration if deemed as inside IR35 and would need to be calculated via the self-assessment.

Accounting – HMRC have been working to make sure that reporting of the deemed payment in company accounts falls in line with accounting standards and to ensure there isn’t any double taxation.

Pension – proposals to include a pension payment in the deemed salary calculation are an option even though it's not currently an option in the public sector, in order to make the deemed payments 'simpler'.

What can you do now?

It’s important to remember that the core rules around IR35 aren't changing – the change is based around who's making the decision on the worker's IR35 status (the end client) and if caught, how the payment is made. Although the changes aren't coming into play for another 12 months, until April 2020, you'll still want to:

- Have your current contract reviewed by an IR35 specialist to make sure you know where this sits with IR35.

- Work through HMRC’s online CEST tool and see what result this gives you.

- Keep an eye on any contract extensions/new contracts that'll roll over into April 2020 and see how the client is handling the process.

Next steps

The results of the consultation will inform the draft Finance Bill legislation, expected to be published in Summer 2019, with the rule changes coming into play on April 2020. This is a very turbulent time for UK politics so we will keep a close eye on this consultation and keep you up to date with any changes.